Master Limited Partnerships (MLPs)

- Natural Gas Liquids (NGLs): NGLs are extracted from the raw natural gas stream into a liquid mix (consisting of ethane, propane, butane, iso-butane, and natural gasoline). The NGLs are then typically transported via pipelines to fractionation facilities.

- General partner (GP): The GP manages the day-to-day operations of the partnership, generally has a 2% ownership stake in the partnership and is eligible to receive an incentive distribution (through the ownership of the MLPs’ incentive distribution rights).

- Limited partners (LPs): The LP provides capital, has no role in the MLPs’ operations or management and receives cash distributions.

- Incentive Distribution Rights (IDRs): IDRs allow the holder (typically the general partner) to receive an increasing percentage of the incremental distributed cash flows. In most partnerships, IDRs can reach a tier wherein the GP is receiving 50% of every incremental dollar paid to the LP unitholders. This is known as the 50/50 or “high splits” tier. IDRs are used to align the interest of all parties in a partnership.

- C-Corporation (C-Corp): A C-corporation is a legal structure that businesses can choose to organize themselves under to limit their owners’ legal and financial liabilities.

What are Master Limited Partnerships?

Master Limited Partnerships (MLPs) are tax-advantaged and yield-oriented publicly traded U.S. infrastructure assets that operate primarily in the oil and gas midstream industry. Their core midstream oil and gas pipelines typically employ “toll-road-like” fee-based business models to handle, process and transport oil, natural gas, natural gas liquids (NGLs) and refined products from the point of production to distribution. The structure of the MLP business model combined with their critical asset base contributes to the industry’s high barriers to entry, generally predictable revenues and limited direct commodity price exposure, offering a number of potential benefits for investors.

Understanding MLPs

MLPs typically consist of a general partner (GP) and limited partners (LPs). For tax efficiency at the organizational level, MLPs are structured as pass-through partnerships rather than public corporations and trade in the form of units. MLPs pay no corporate-level taxes, which are instead borne by unitholders (shareholders) at their individual tax rate. This tax structure eliminates the double taxation of profits that typically occurs when investing in corporations. The GP holds a minority stake (~2%), but retains full management responsibility of the business and may own the incentive distribution rights (IDRs). An IDR is often used to align incentives between GP and LPs by stipulating how future cash flows will be allocated between LPs and GP. LPs receive cash distributions and provide capital, but have no role in daily operations or management and have limited voting rights. Some MLPs are registered as limited liability corporations (LLCs), and therefore have members and membership interests rather than unitholders and units, and no GP nor IDRs. However, LLCs retain their tax advantage and are treated as partnerships.

What qualifies as an MLP?

The MLP structure was broadly established by the Tax Reform Act of 1986 and the Revenue Act of 1987. The first act created tax-free publically traded partnerships and the latter specified that an MLP must derive at least 90% of its gross income from qualifying sources, which are defined as real estate and natural resources. Today, MLPs are primarily focused on energy- and natural resource-related activities, with a majority engaged in the oil and gas midstream segment.

What is midstream energy?

The midstream oil and gas industry gathers, processes, transports and stores natural gas, NGLs, crude oil and related energy commodities, representing the diverse and critical energy infrastructure assets linking supply to end-user demand. After the commodity is extracted from the ground, midstream assets perform the remaining processes required to meet end-user demand. These include:

- Gathering: Network of smaller-diameter pipes that transport raw natural gas from the wellhead to downstream pipelines or central points.

- Processing: Removes impurities from raw natural gas in order to meet specifications for transportation, including dehydration (removes water), treatment (removes carbon dioxide and hydrogen sulfide) and extraction of NGLs.

- Fractionation (fracking): Separates the mixed NGLs into its components through heating.

- Storage: Storage of natural gas, NGLs, crude and refined products in tanks, wells, depleted reservoirs and other storage facilities, providing necessary flexibility for the energy economy in times of higher demand.

- Transportation: Movement of various product types across the country through natural gas, NGL, crude and refined product pipelines, representing the cornerstone of the midstream asset class.

While businesses at different points in the midstream energy value chain have distinct growth opportunities and varying degrees of risk, the underlying operations will be the same whether the company is structured as an MLP or a C-Corporation (C-Corp). Importantly, MLPs and midstream energy firms generally operate under a toll-road business model to handle, process and transport energy commodities. Revenues are typically fee-based and dependent on volume and throughput, which limits direct commodity price exposure.

Why invest in MLP and midstream equity?

MLPs may offer investors a number of potential benefits, coupled with specific risks. Investors can potentially manage the risks in MLPs by diversifying their holdings across issuers and by carefully monitoring each issuer’s financial health.

Potential benefits:

- Total return: MLPs, as measured by the Alerian MLP Index, have historically exhibited strong performance in various market environments, outperforming the S&P 500 Index in 13 of the past 18 years.*

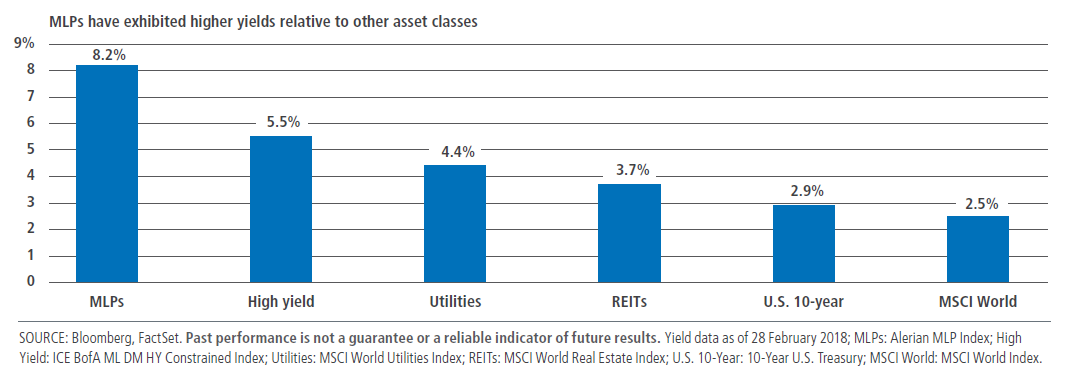

- High distributions: MLPs offer high distributions relative to most other asset classes as they typically distribute 70-100% of their cash flow to investors.

- Cash flow stability: MLPs generally operate under long-term fee-based contracts with limited direct commodity price exposure.

- Inflation hedge: Distribution growth has outpaced, and is often linked to, inflation.

- Lower beta to energy markets: MLPs, as measured by the Alerian MLP Index, have historically demonstrated higher total returns and lower risk relative to the S&P 500 Energy Index.

Potential risks:

- Dependence on capital markets: To fund growth projects or acquisitions MLPs rely on third-party debt and equity capital at cost effective terms which can be impacted by retail investor sentiment.

- Exposure to commodity markets: A drop in long-term oil price expectations materially below $50 may bring sustainability of underlying volumes into question.

- Interest rate risk: While MLPs have historically demonstrated low to negative correlations to interest rates, the sector may be vulnerable to higher rates due to their income orientation.

- Regulatory risks: Project permitting, rate or tariff decisions and changes to the tax law may affect MLPs ability to grow and operate their businesses.

- Conflicts of interest: Similar to other forms of incorporation, the interests of management (GPs) and capital (LPs) may differ at times.

Midstream energy: Active vs. passive

When investing in MLPs and midstream energy, investors should consider the potential tradeoffs between active and passive management, paying particular attention to the following factors:

- Investable universe: An active approach to midstream energy is not limited by corporate structure, and can take advantage of the larger midstream opportunity set, which includes MLPs and the growing list of midstream C-Corps. Passive management on the other hand, is typically constrained by an MLP-only benchmark index.

- Retail investor base: Retail assets currently comprise a majority of MLP investors. While institutional capital tends to be more long-term and total-return-focused, retail often trades on sentiment, commodity prices and distribution yields and dates. An active approach to midstream energy may have the flexibility to take advantage of the inherent seasonality and technicals that arise from a large retail base.

- Differences in quality: The MLP opportunity set consists of approximately 100 companies representing more than $400 billion in equity market capitalization. While this universe consists of all MLPs, it is anything but homogenous with vast differences in quality among constituents. For example, the spread between the best and worst performing stock in the Alerian MLP Index in 2017 was a staggering 95%. Active management supported by deep fundamental research has the potential to identify companies that are likely to outperform while avoiding those that are likely to underperform.

Source: Master Limited Partnership Association, 2017, PIMCO

CMR2018-0316-321937

Disclosures

Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in MLPs involves risks that differ from equities, including limited control and limited rights to vote on matters affecting the partnership. MLPs are a partnership organized in the US and are subject to certain tax risks. Conflicts of interest may arise amongst common unit holders, subordinated unit holders and the general partner or managing member. MLPs may be affected by macro-economic and other factors affecting the stock market in general, expectations of interest rates, investor sentiment towards MLPs or the energy sector, changes in a particular issuer’s financial condition, or unfavorable or unanticipated poor performance of a particular issuer. MLP cash distributions are not guaranteed and depend on each partnership’s ability to generate adequate cash flow.

Statements concerning financial market trends are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

PIMCO does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Any tax statements contained herein are not intended or written to be used, and cannot be relied upon or used for the purpose of avoiding penalties imposed by the Internal Revenue Service or state and local tax authorities. Individuals should consult their own legal and tax counsel as to matters discussed herein and before entering into any estate planning, trust, investment, retirement, or insurance arrangement.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2018, PIMCO.